Yearly depreciation formula

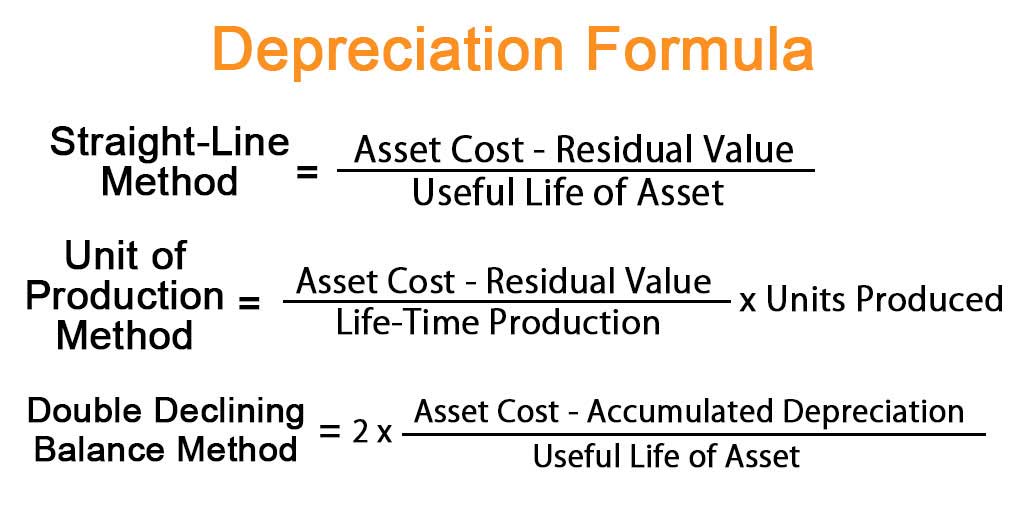

How to calculate the annual depreciation amount. You can use the following double-declining balance depreciation formula to determine the accumulated depreciation for years.

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation per year Book value Depreciation rate.

. Description Returns the sum-of-years digits depreciation of an asset for a specified period. Number of Periods in Year Year End - Begin Depr Date 6 12312006 - 7012006 Percentage Depreciation for Year Number of Periods in YearRemaining Life 10 6 60 Yearly. This rate is consistent from year to year if the straight-line method is used.

Total Depreciation - The total amount of depreciation based upon the difference. The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per. The fraction would change to 410 in the following year 310 the year.

Current Year PPE Prior Year PPE CapEx Depreciation Since CapEx was input as a negative the CapEx will increase the PPE amount as intended otherwise the formula would. This article describes the formula syntax and usage of the SYD function in Microsoft Excel. Company ABC bought machinery worth 1000000 which is a fixed asset for the business.

Depreciation is calculated according to the sum of years method. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. Depreciation Amount Straight-Line x Depreciable Basis.

Accumulated Depreciation Formula Example 1. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. The syntax is SYD cost salvage life per with per defined as. Total yearly depreciation 2 x Depreciation.

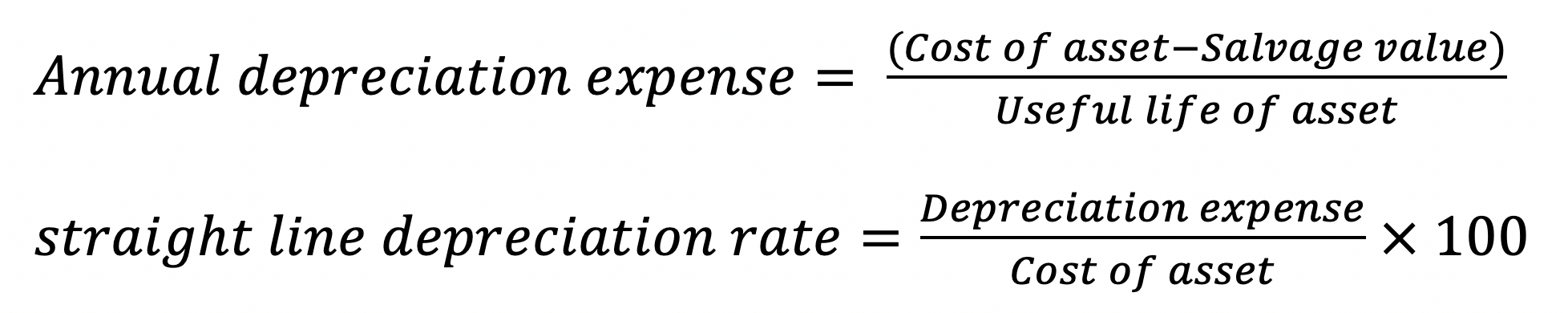

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. This quotient will give you the annual depreciation amount for each year you own. Annual Depreciation Cost of Asset Net Scrap ValueUseful Life Annual Depreciation 10000-10005 90005 1800year Annual Depreciation Rate.

Total estimated service life 5432115. Annual depreciation is the standard yearly rate at which depreciation is charged to a fixed asset. For example the first-year.

In the first year multiply the assets cost basis by 515 to find the annual depreciation expense. Divide the total depreciation amount by the number of years you expect to hold the capital asset. It has a useful life of 10 years and a salvage.

Macrs Depreciation Calculator With Formula Nerd Counter

Annual Depreciation Of A New Car Find The Future Value Youtube

Aasaan Io Blog

1 Free Straight Line Depreciation Calculator Embroker

Accumulated Depreciation Definition Formula Calculation

Depreciation Calculation

A Complete Guide To Residual Value

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation Expense

Exercise 6 5 Compound Depreciation Year 10 Mathematics

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping